Your “charitable checking account” for creating FOREVER VALUE

What is a Donor Advised Fund (DAF)?

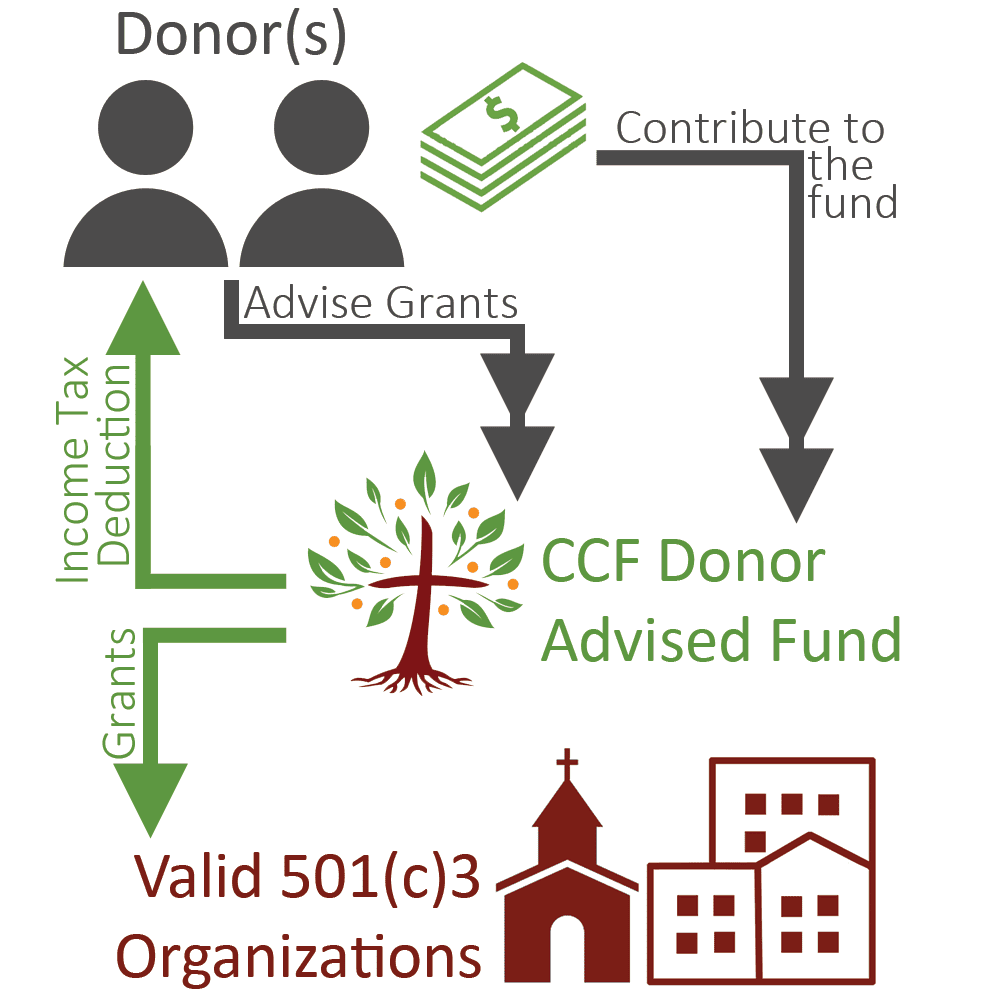

A Donor Advised Fund is a tax-advantaged, convenient vehicle for donating to all the organizations you already love. The donor receives the full tax deduction in the year that the contribution is made to their DAF, but the donor then can take their time in deciding when and to whom they would like to grant this money.

A DAF may advise grants for up to two lifetimes, creating a legacy of philanthropy within a family. The investments will grow tax-free for future grants to charitable causes. In the case of appreciated assets, a Donor Advised Fund can assist you in turning capital gains into charitable gains!

Why a DAF with the Catholic Community Foundation?

We know you have choices in the administration of a Donor Advised Fund. Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission; all fees on our DAFs further the Foundation’s mission and the impact that we have on our local community.

We know you have choices in the administration of a Donor Advised Fund. Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission; all fees on our DAFs further the Foundation’s mission and the impact that we have on our local community.

As an active grantmaker to the local Catholic Community, we are well equipped to advise you about effective programs and organizations that would benefit from your support. Donor Advised Funds with the Foundation can grant to any qualified 501(c)3 as long as the charitable organization engages only in work that aligns with Catholic social teachings. All of the Foundation’s funds are managed under USCCB guidelines for socially responsible investing.

Bunching & DAFs: Great for Charity, Great for your Taxes

Bunching your charitable donations into a Donor Advised Fund is a win-win for your taxes and for the charities you donate to regularly. Read our article with a 4-year comparison to learn why!

When we were looking to expand our charitable giving, a Donor Advised Fund appealed to us because of the convenience of giving and the opportunities for grant-making that matched our philanthropic interests. We have also learned about deserving causes and programs through the helpful communications from the Foundation.

Donor Advised Funds at a Glance

Benefits

- Great way to get a tax break when you have a large taxable event (e.g. IPO stock) but want to take your time advising where they money will go

- Serves as a clearing house for all your stock so that it’s simple to give to smaller organizations that can’t process stock

- A fund can grant for up to two lifetimes which creates a legacy of philanthropy in that family

- “Kitchen Table Philanthropy” using a DAF encourages families to think about charity together and teaches children about social impact

Financial

- $10,000 minimum starting investment

- 1% annual fee which helps fund the Foundation’s mission and impact on our local community

- Individual grant requests must be at least $250

- We recommend 25% of grants support local Catholic causes

- All funds are managed under the United States Conference for Catholic Bishops (USCCB) guidelines for socially responsible investing

Services

- Individualized customer service and recommendations of organizations for granting based on your interests

- Donor may advise grants to non-Catholic organizations that do not go against Catholic social teaching

- Online portal allows access to fund balances, grant history, gift history, & database of grantees

- Advise grants to organizations anywhere in the US

- Grant checks will be mailed within 30 days of the request

- No limit on the number of grants a donor can recommend

Donor Advised Fund vs. Private Foundation

| Donor Advised Fund | Private Foundation | |

| Cost | Annual fee of 1% | Often requires employing lawyers, accountants and staff, as well as other administrative expenses. |

| Administrative Requirements | The Foundation will establish an individual fund in your name. We manage investing, accounting and state and federal reporting. | An individual 501(c)3 organization must be established and will require filing with the IRS for charitable tax exemption status. Responsible for compliance with federal and state guidelines. |

| Tax Benefits | Charitable deduction of 100% fair market value for most gifts of long term capital gain | Charitable deduction often limited to donor cost. Subject to additional federal taxes that DAFs are not. |

| Flexibility | No annual payout requirement. Grant funds at your own pace, however you choose. | Subject to a 5% annual grant payout. |

| Privacy | Choose whether to gift publicly or anonymously. | No anonymity option. |